Anodized Metal Finishes Where Supplier Process Control Determines Performance and Appearance

Anodized metal is often described as a finishing step, but in real manufacturing environments, it acts as a clear indicator of how well a supplier controls their processes. Buyers recognize this quickly through visible outcomes: consistent color across parts, uniform surface texture, stable dimensions after finishing, and approvals that move forward without repeated corrections.

The same aluminum alloy can produce very different results depending on how consistently surface preparation, anodizing parameters, and post-treatment handling are managed. While buyers may initially specify anodized metal for corrosion resistance or visual appeal, what they ultimately evaluate is whether a supplier can deliver the same result across batches, programs, and production volumes.

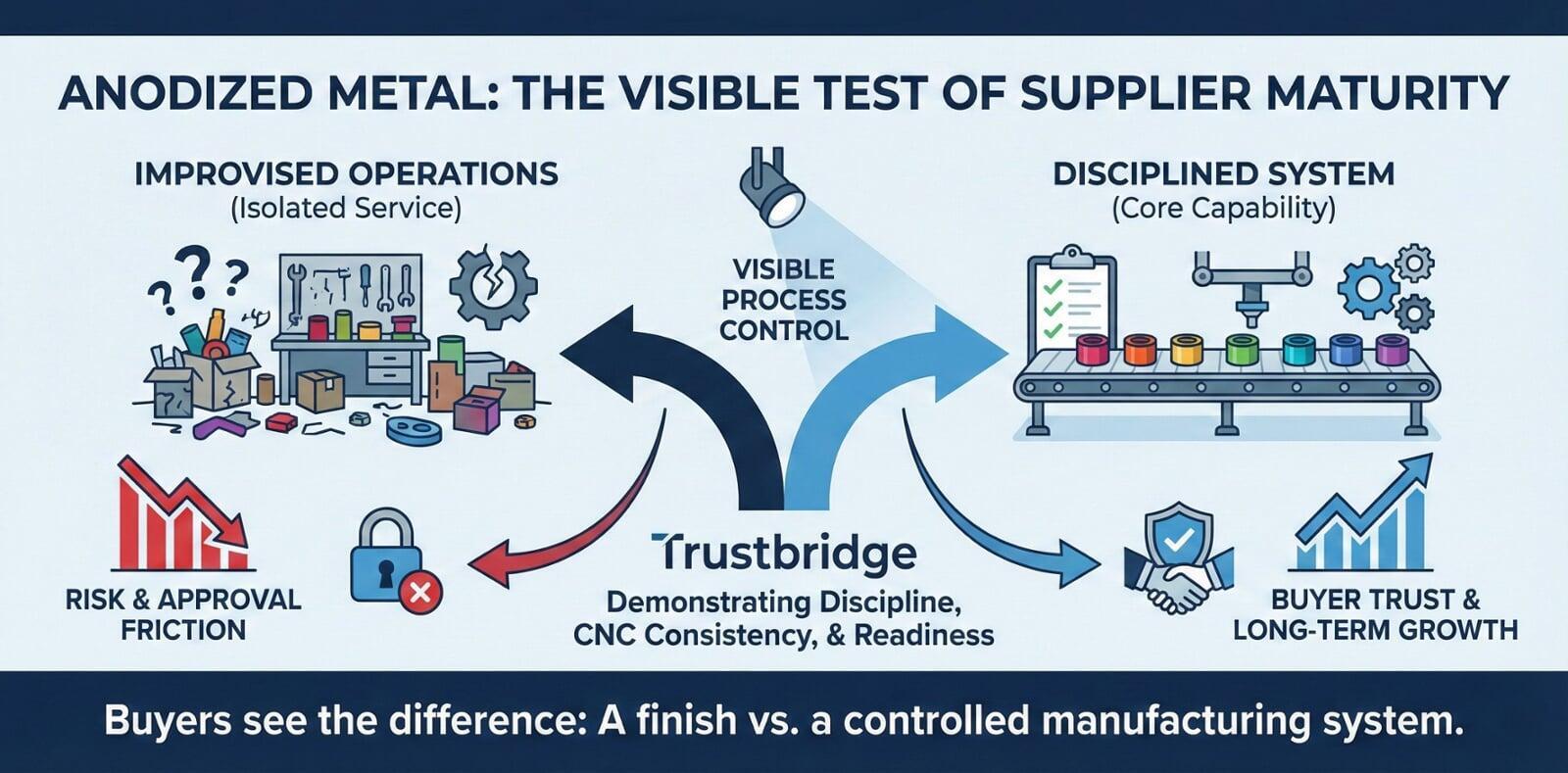

For suppliers, anodizing is not a cosmetic choice. It is a visibility point into manufacturing discipline. Shops that treat anodized metal as a controlled system tend to earn buyer confidence through smooth inspections and predictable approvals. Those that treat it as a last-step operation often reveal variability that slows approvals and weakens long-term trust.

What Anodized Metal Really Represents in Supplier Manufacturing

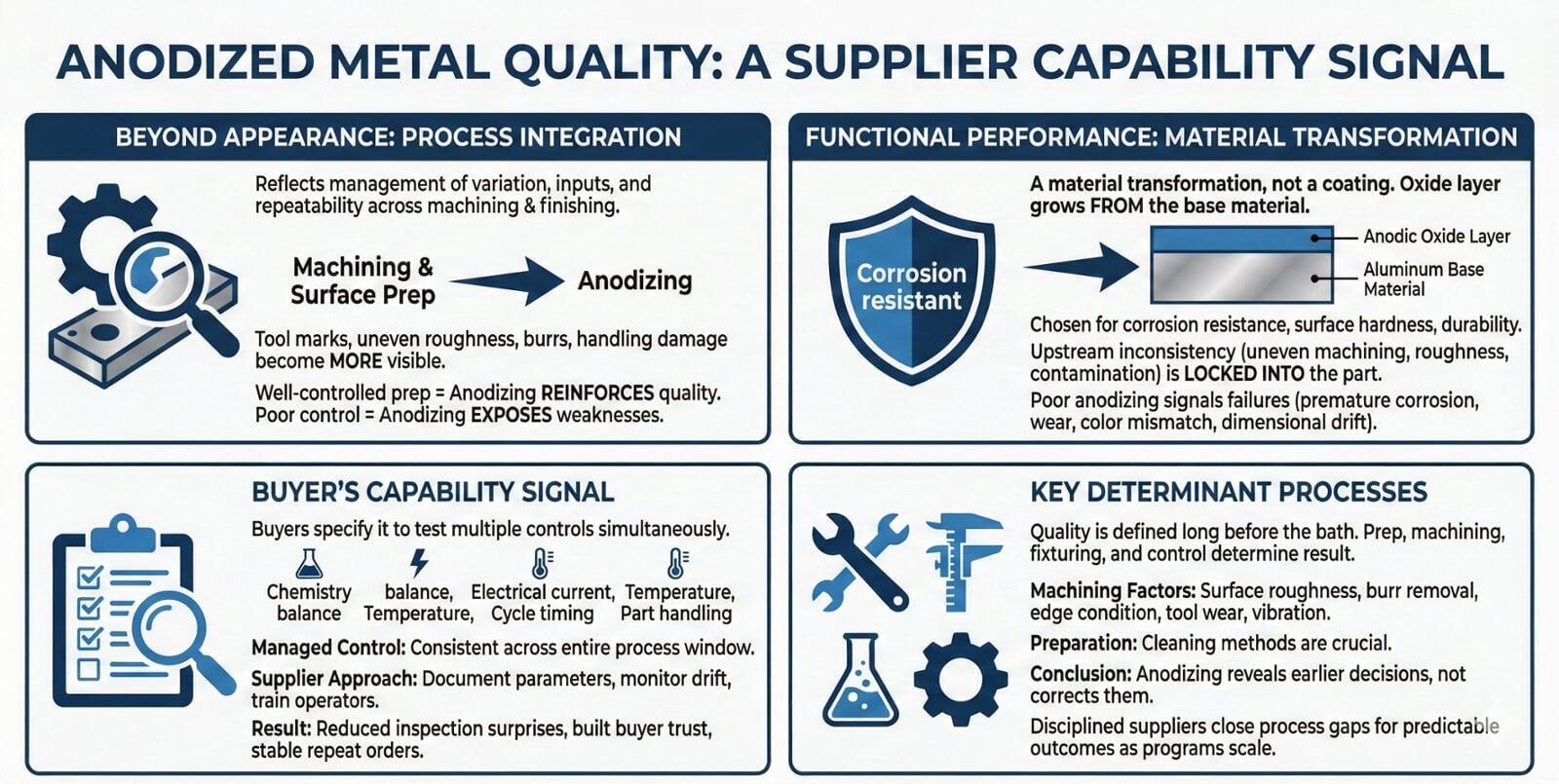

Within supplier operations, anodized metal represents far more than surface appearance. It reflects how effectively a shop manages variation, inputs, and repeatability across both machining and finishing stages. Buyers implicitly assess whether anodizing is integrated into the manufacturing system or treated as an isolated service performed after machining is complete.

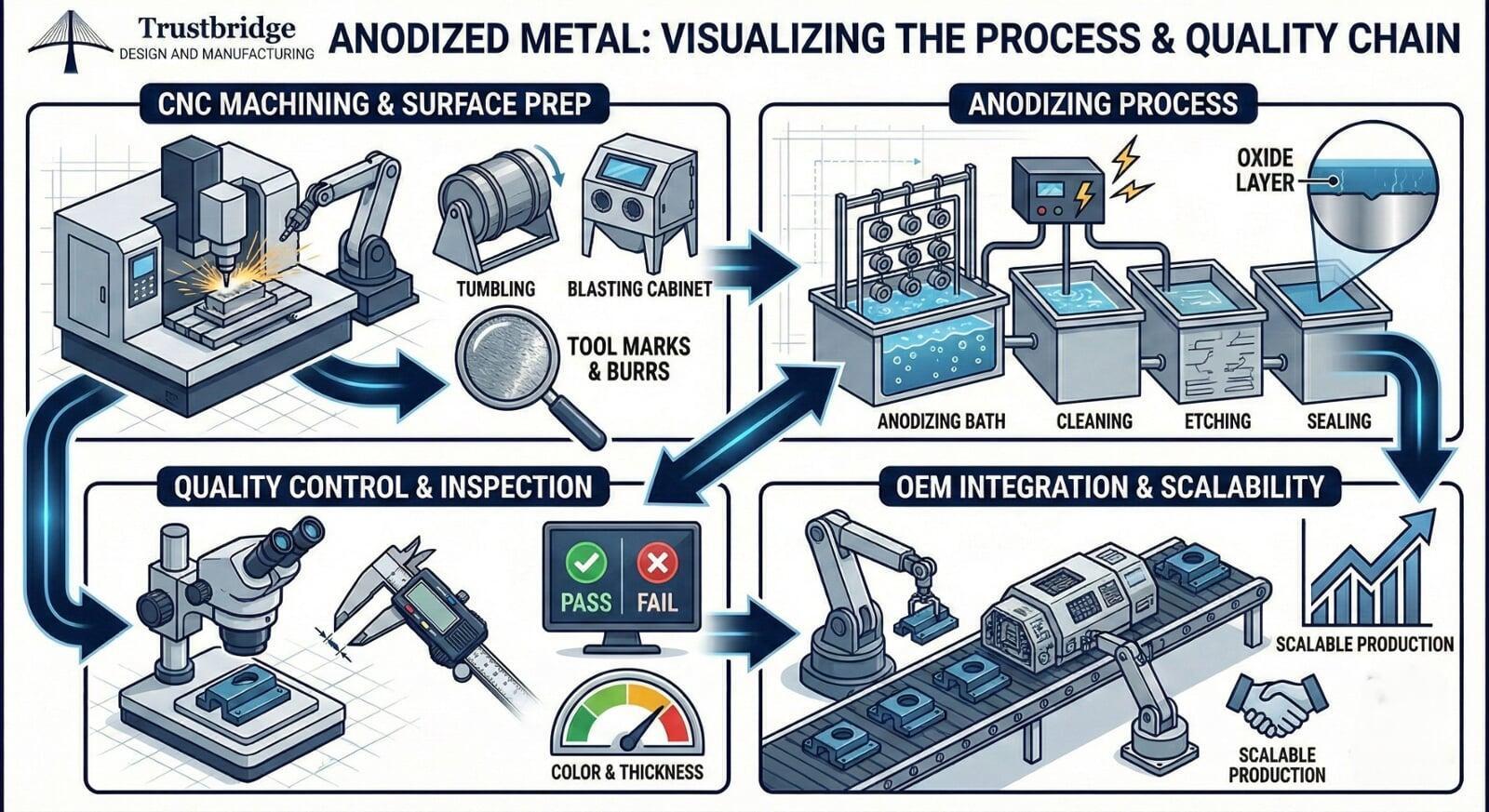

This difference becomes obvious when machining quality and surface preparation are considered. Tool marks, uneven surface roughness, burrs, and handling damage do not disappear during anodizing. Instead, they become more visible. When machining and preparation are well controlled, anodizing reinforces quality. When they are not, anodizing exposes weaknesses.

For suppliers, anodizing becomes a proof point. High-control shops show consistent color, thickness, and dimensional stability across batches. Low-control shops struggle with shade variation, surface defects, or dimensional shift that signals deeper process gaps to buyers.

Beyond Appearance to Functional Performance

Anodized metal finishes are chosen for corrosion resistance, surface hardness, and durability. From a manufacturing standpoint, anodizing is a material transformation, not a coating applied on top. The oxide layer grows from the aluminum itself, permanently reflecting the condition of the base material.

Upstream inconsistency includes uneven machining, variable surface roughness, contamination from handling, or inconsistent cleaning before anodizing. These issues become locked into the part during finishing. Buyers associate poor anodizing with failures such as premature corrosion, uneven wear, color mismatch across assemblies, or dimensional drift that affects fit. These failures rarely appear isolated—they signal deeper control problems within the supplier’s process.

Trustbridge Tip: Measurement Data Is Also a Signal of Market Readiness

Design accuracy is often treated as an internal quality concern, but for many manufacturers, consistent measurement outcomes shape how buyers perceive reliability long before price or capacity enter the discussion. Parts that inspect cleanly, repeatedly, and predictably usually trigger fewer clarification cycles, fewer RFQ follow-ups, and less friction during supplier evaluation.

When designers use CMM feedback to stabilize geometry and reduce variability early, inspection results become easier to communicate and defend during sourcing discussions. Over time, this clarity affects how frequently buyers re-engage suppliers whose parts behave consistently across programs and volumes, reinforcing why measurement discipline often correlates with stronger inbound manufacturing demand.

Why Buyers Use Anodizing as a Capability Signal

Buyers often specify anodized metal because it tests multiple controls at once. Chemistry balance, electrical current, temperature, cycle timing, and part handling must all stay within tight limits simultaneously. Managing one variable well is not enough—control has to be consistent across the entire process window.

Suppliers who recognize this treat anodizing as a credibility checkpoint. They document parameters, monitor drift, and train operators to respond to variation. This approach reduces inspection surprises and builds buyer trust because results remain stable across repeat orders and production ramps.

The Supplier Processes That Determine Anodized Metal Quality

Anodized metal quality is defined long before parts enter the anodizing bath. Surface preparation, machining consistency, fixturing choices, and parameter control together determine the final result. Buyers may only see the finished part, but they infer process stability from finish uniformity, dimensional consistency, and how smoothly approvals proceed.

Preparation and machining factors include surface roughness, burr removal, edge condition, tool wear, vibration, and cleaning methods. Anodizing does not correct earlier decisions it reveals them. Suppliers who fail to connect these stages often label defects as “unexplained,” when they are actually system gaps between operations.

Disciplined suppliers close these gaps by design, creating anodizing outcomes that remain predictable as programs scale.

Surface Preparation as the Hidden Differentiator

Surface preparation is where most anodizing defects originate, even though they are often discovered much later during inspection. Inconsistent cleaning, uneven etching, or contamination can all cause adhesion issues or color variation that appear to be anodizing problems but actually start earlier.

Suppliers with strong anodized metal results standardize preparation in practical ways: defined cleaning sequences, controlled dwell times, validated chemicals, and clear handling rules between machining and finishing. The handoff between operations is a major risk window, and shops that manage it carefully prevent damage that often goes unnoticed until final inspection.

Process Control During Anodizing Operations

Anodizing operates within a narrow process window. Electrical current density, bath temperature, chemistry balance, and cycle timing all directly affect finish quality. Many deviations are subtle and only become visible when parts are compared side by side or when production scales beyond early builds.

Suppliers who document and monitor these variables deliver finishes buyers trust across repeat orders. Those who rely on informal adjustments often struggle with consistency as volume increases.

Trustbridge Tip: CMM Feedback Strengthens Supply Chain Resilience at the Design Level

Supply chain resilience is often discussed in terms of sourcing strategies and logistics, but it also begins with how well a design tolerates variation across different manufacturing environments. Parts that rely on fragile tolerances or unclear datum schemes often fail when production shifts between suppliers, regions, or constrained facilities.

By using CMM data to identify which features remain stable and which drift under different setups, designers create geometry that adapts more easily across suppliers. This measurement-informed approach reduces dependence on single-process assumptions and supports more flexible production planning when supply conditions change unexpectedly.

Anodized Metal in CNC Machining Services and OEM Programs

Anodized metal performance cannot exceed machining quality. Machined surface condition, tool marks, and dimensional stability directly shape anodizing behavior. Some machining defects only become visible after anodizing magnifies them, which is why buyers evaluate machining and finishing as a single system.

For OEM programs, anodized metal often acts as an early indicator of whether a supplier can scale without introducing downstream risk.

Linking Machining Consistency to Finish Outcomes

Anodizing rarely introduces defects—it reveals and amplifies machining variation. Poor surface finish, unstable fixturing, or inconsistent tool paths all become more noticeable after anodizing.

Suppliers who machine with anodizing in mind deliver more stable visual and functional results and avoid late-stage inspection surprises.

Why OEM Buyers Evaluate Anodizing Early

OEMs often use anodized parts as an intentional early stress test. Approval delays caused by finish issues raise immediate concerns about scalability, documentation, and internal controls.

Suppliers who manage anodizing proactively shorten approval cycles and strengthen OEM confidence before programs move to higher volumes.

Anodizing Control as a Supplier Selection Criterion

Supplier selection increasingly prioritizes predictability over claimed capability. Anodized metal performance provides buyers with a fast, visible way to assess how a supplier actually operates. Consistent finishes offer observable evidence of process control with minimal investigation.

Suppliers who clearly explain how they manage anodizing risk stand apart from those who simply list anodizing as an available service.

How Buyers Compare Suppliers Beyond Price

When pricing and lead times converge, buyers focus on risk. Anodizing quality becomes a deciding factor because inconsistent finishes create approval delays, rework, and downstream problems.

Buyers prefer suppliers who reduce uncertainty through repeatable outcomes rather than those offering marginal cost savings with higher risk. Over time, anodized metal consistency becomes a proxy for overall process discipline.

Anodized Metal and Approval Confidence

Buyers remember approval experiences. Suppliers whose anodized parts pass inspection cleanly become associated with low-friction programs, while those that require repeated fixes are seen as higher risk in future sourcing decisions.

Consistent anodizing builds positive buyer memory that carries forward into new programs.

The Operational Risks of Undisciplined Anodizing

Undisciplined anodizing introduces risks that surface late and cost more to fix. Finish variation, corrosion failures, and dimensional drift slow programs and weaken buyer confidence.

Buyers recognize patterns over time. Repeated anodizing issues signal unreliable control, regardless of individual defect severity. Suppliers who struggle here often lose OEM trust rather than just individual orders.

Turning Anodizing into a Competitive Advantage

Suppliers who standardize anodizing workflows reduce variation, speed approvals, and simplify scaling. Buyers respond by increasing repeat programs and expanding scope because operational risk is lower.

In this way, anodizing becomes an asset rather than a liability.

Conclusion Anodized Metal Is a Test of Supplier Maturity

Anodized metal finishes reveal whether a supplier operates with discipline or improvisation. Buyers do not evaluate anodizing in isolation—they interpret it as evidence of broader manufacturing control.

Suppliers who treat anodizing as a core operational capability—defined processes, monitored variables, and controlled handoffs—build trust, reduce approval friction, and support long-term growth.

Winning suppliers make process control visible at the moments buyers care about most: inspections, approvals, and early program decisions. Trustbridge helps suppliers demonstrate anodizing discipline, CNC consistency, and approval readiness where buyer confidence is formed. If anodized metal is part of your value proposition, ensure buyers clearly see the difference between a finish and a controlled manufacturing system.

Frequently Asked Questions (FAQs)

1. Why is part accuracy often challenged after manufacturing, even with precise CAD models?

CAD models represent ideal geometry, but manufactured parts are affected by machining forces, fixturing variation, thermal changes, and tool behavior. These factors can cause small deviations that only become visible during inspection, making accuracy a manufacturing not just a design challenge.

2. How do Coordinate Measuring Machines (CMMs help designers validate accuracy?

CMMs provide precise, repeatable measurements of real parts against design intent. By comparing measured data to CAD and GD&T requirements, designers can see where tolerances are realistic, where variation occurs, and which features are most sensitive to manufacturing conditions.

3. What role does GD&T play when using CMMs for inspection?

GD&T defines how parts should be measured, not just what size they should be. CMMs are especially effective at evaluating positional tolerances, flatness, concentricity, and profile helping designers confirm that functional requirements are being met, not just nominal dimensions.

4. Why is early CMM feedback valuable during prototyping and first articles?

Early CMM results highlight tolerance stack-ups, unstable features, or inspection challenges before full production begins. This allows designers to adjust features or tolerances early, reducing rework, scrap, and approval delays later in the program.