POM Material: The Keys to Assessing Strength, Machinability, and Long-Term Performance

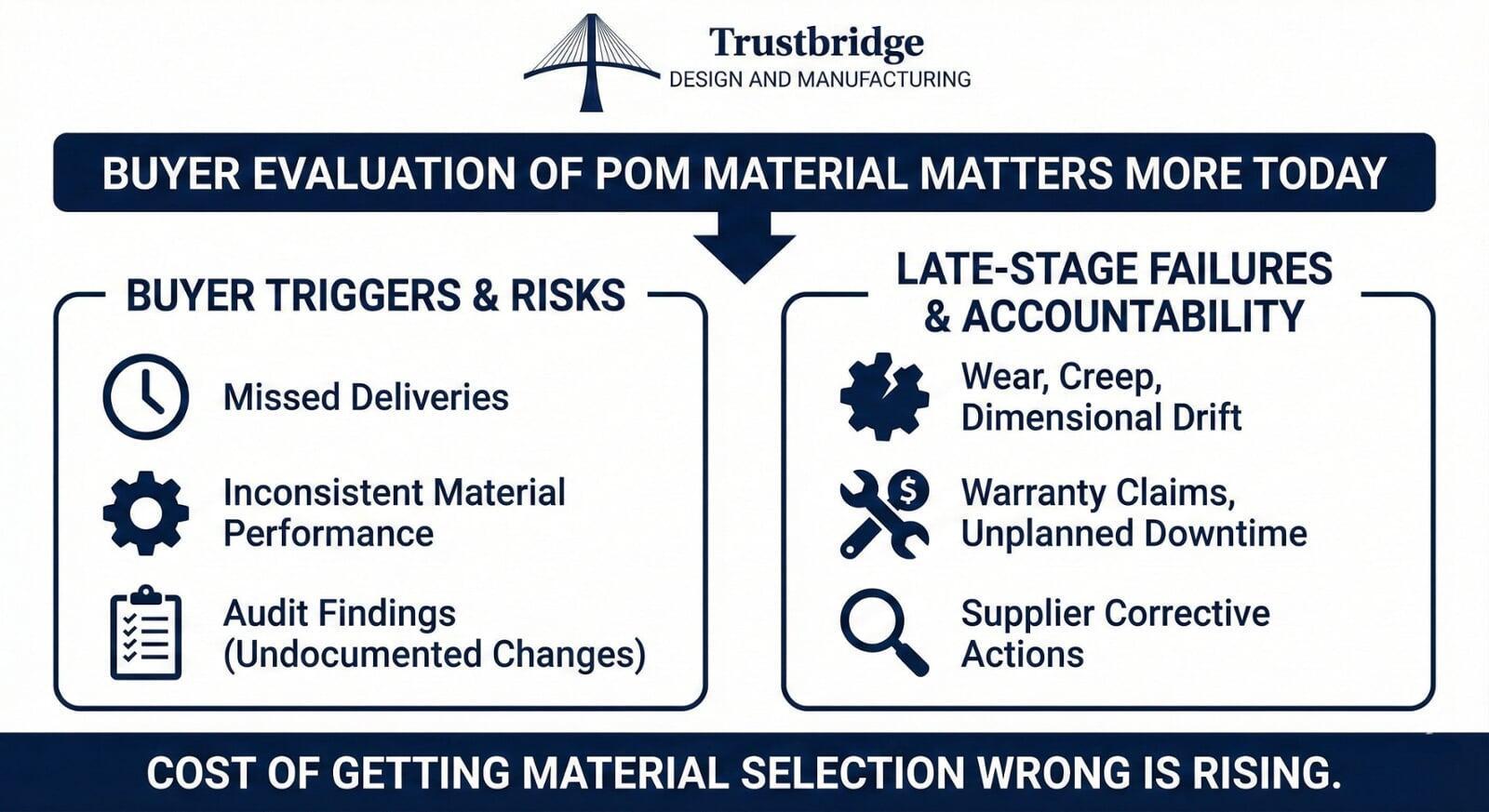

In today’s manufacturing environment, procurement managers, supplier quality engineers, and sourcing leads are under growing pressure to make material and supplier decisions that hold up beyond launch. When selecting POM material, also known as acetal or polyoxymethylene, the evaluation goes far beyond datasheets and tensile strength values. Buyers are increasingly accountable for outcomes such as scrap reduction, warranty exposure, audit findings, and supplier scorecard performance.

Rather than asking only whether this material meets design requirements, buyers now focus on whether the supplier behind it can deliver repeatable quality, documented compliance, and stable production over multi-year programs. Poor decisions here often result in measurable consequences, including delayed approvals, increased corrective actions, or unexpected field failures.

This shift has made POM evaluation a strategic sourcing decision. Strength, machinability, and durability still matter, but they are now assessed through a practical decision framework that ties material properties directly to supplier risk management, vendor vetting rigor, and production readiness.

Why Buyer Evaluation of POM Material Matters More Today

The way buyers evaluate engineered plastics has changed noticeably over the last few years. Global supply instability, more frequent supplier transitions, and tighter customer audits have increased exposure when sourcing precision polymer components. For POM in particular, where performance issues may not appear immediately, early evaluation gaps can remain hidden until volumes scale.

Buyers are increasingly responding to triggers such as missed deliveries during supplier transitions, inconsistent material performance after resin substitutions, or audit findings tied to undocumented process changes. These realities have raised the cost of getting material selection wrong.

Buyers choosing POM are often sourcing gears, bushings, housings, or other precision components where wear, creep, or dimensional drift may not surface until thousands of cycles into use. When failures appear late in the lifecycle, accountability often traces back to supplier capability, not just design intent.

Market Pressure, Supply Chain Risk, and Accountability

Shorter launch timelines and supplier consolidation mean buyers rely on fewer partners for critical components. At the same time, procurement teams are measured on cost stability, supply continuity, and quality performance, creating an accountability gap when material risks are not surfaced early.

Stable quality, from a buyer’s perspective, means consistent resin sourcing, controlled processing parameters, and repeatable machining outcomes across production volumes. Suppliers lacking these controls may perform well at prototype stage but struggle to maintain continuity once demand increases.

For example, inconsistent acetal batches may meet incoming inspection requirements yet introduce subtle changes in crystallinity or wear behavior. These issues often surface as gear wear or noise after extended use, driving warranty claims, unplanned downtime, or costly supplier corrective actions that far exceed the original part cost.

Trustbridge Tip: When sourcing POM material components, strength and machinability matter but supplier capability matters even more. Buyers should not only evaluate material properties but also how well a partner handles vendor vetting, compliance, and production readiness. Thorough vetting identifies partners who understand engineering plastics, maintain controlled processes, and deliver consistent performance over time. To improve your partner evaluation framework and reduce supplier risk, read: How to Vet Manufacturing Partners for Your Projects.

How Buyers Evaluate Strength and Mechanical Reliability of POM Material

Strength is a primary reason buyers specify POM over other plastics or metals, particularly for load-bearing or moving components. However, buyers differentiate between nominal material strength and application-critical strength, especially where fatigue resistance and creep behavior matter.

Rather than accepting generic claims, buyers treat strength evaluation as part of due diligence. They look for evidence that suppliers understand how mechanical performance behaves under real operating conditions and production variation.

Strength Consistency Across Production Batches

Buyers closely evaluate whether mechanical properties remain stable across batches and over time. Variations often originate from changes in resin grade, drying practices, melt temperatures, or machining parameters, particularly during scale-up.

From a buyer’s standpoint, evaluation cues include process documentation, lot traceability, and historical performance data. Scale-up risk becomes a red flag when suppliers cannot demonstrate how strength characteristics are maintained as volumes increase.

A capable supplier, in buyer terms, is one that combines controlled processing, documented inspections, and change management discipline. This repeatability directly impacts business outcomes such as reduced revalidation effort, fewer engineering holds, and predictable production planning.

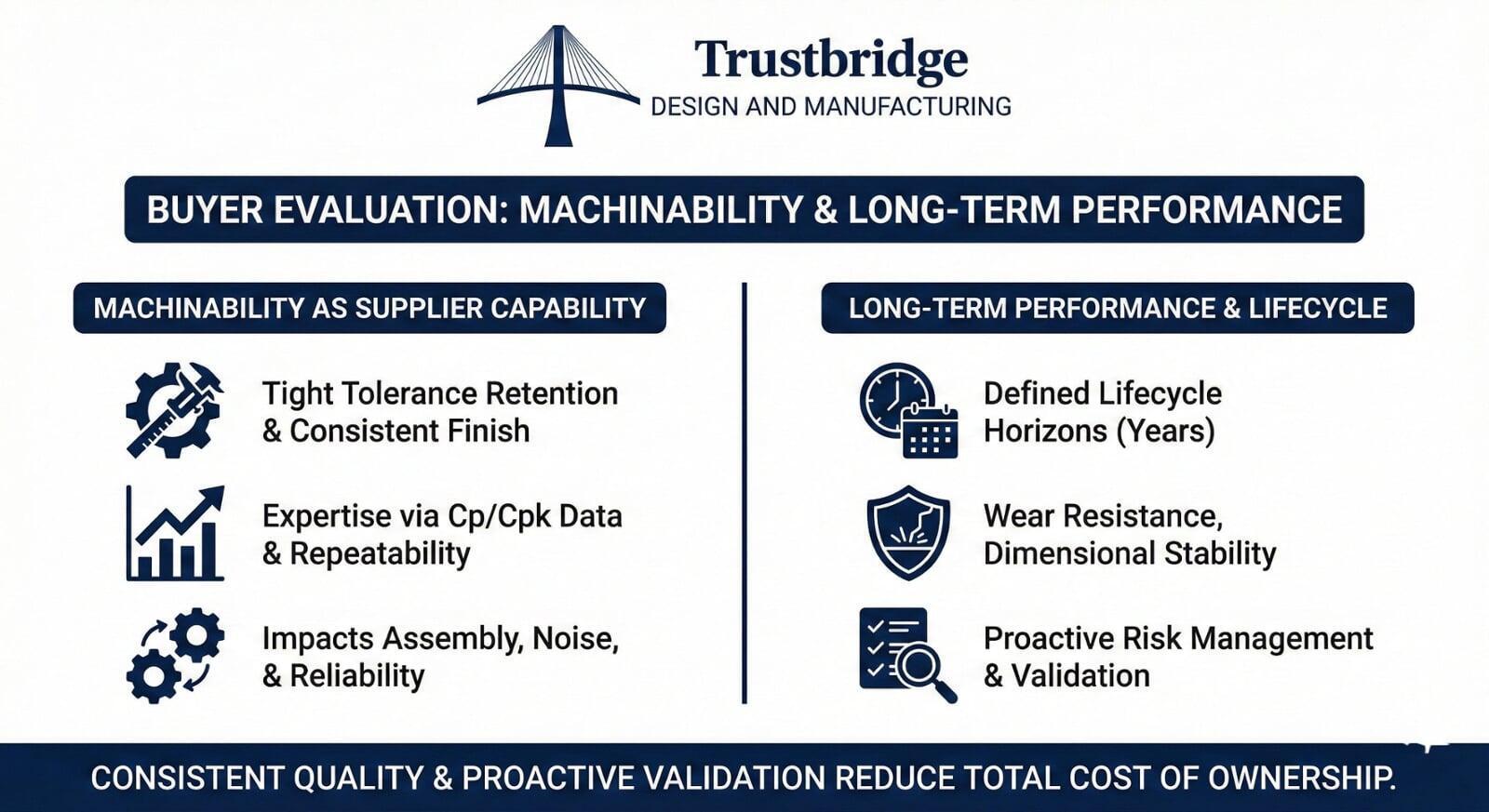

Machinability as a Supplier Capability, Not Just a Material Property

Buyers recognize that machinability is not just about how POM behaves, but how the supplier machines it. In buyer terms, excellent machinability translates to tight tolerance retention, consistent surface finishes, and inspection results that hold over long runs.

Machining quality also affects downstream functions, including assembly fit, noise performance, and overall part reliability, making it a cross-functional concern rather than a shop-floor issue.

Why Machining Expertise Impacts Buyer Confidence

Poor machining practices can introduce stress risers, dimensional instability, or premature wear. Buyers evaluate machining expertise through inspection trends, Cp/Cpk data, and how suppliers respond to deviations during audits.

Expertise shows up in repeatability. Suppliers who understand how polyoxymethylene responds to cutting forces, tooling wear, and thermal effects are better equipped to maintain consistency as volumes scale.

Machining capability also influences buyer KPIs such as on-time delivery, rework rates, and cost predictability. Scalable suppliers prioritize predictability over speed, while reactive suppliers often rely on expediting and manual fixes that degrade scorecard performance.

Long-Term Performance and Lifecycle Expectations

Buyers increasingly evaluate POM performance over defined lifecycle horizons, often spanning several years of production and use. Long-term performance considerations include wear resistance, dimensional stability, and environmental exposure, all of which directly affect total cost of ownership.

For buyers, lifecycle reliability is not theoretical. It influences replacement cycles, service costs, and brand reputation in the field.

Field Performance and Risk Reduction

From a buyer’s perspective, long-term performance is a function of supplier risk management. Proactive suppliers track wear data, validate assumptions during early production, and own field performance insights rather than reacting after failures occur.

Premature degradation in acetal components is frequently tied to process variations such as uncontrolled cooling rates, inconsistent machining parameters, or undocumented resin changes. Buyers value suppliers who validate long-term performance early and clearly communicate potential risks before parts reach the field.

Vendor Vetting and Supplier Compliance in POM Sourcing

Vendor vetting has evolved into a structured process that includes quality systems review, change control assessment, and continuity planning. Buyers increasingly own this process to protect supply stability rather than relying on reactive audits.

Effective vetting ensures suppliers can sustain performance across personnel changes, volume shifts, and market disruptions.

Role of ISO 13485 and AS9100 Certification

For POM components used in regulated or high-reliability applications, certifications like ISO 13485 and AS9100 demonstrate controlled processes, documented traceability, and disciplined change management.

Buyers do not view certification as a checkbox. They associate it with outcomes such as fewer nonconformances, smoother audits, and reduced internal oversight. Even outside regulated sectors, certified suppliers are seen as better able to control costs, manage risk, and maintain consistent performance.

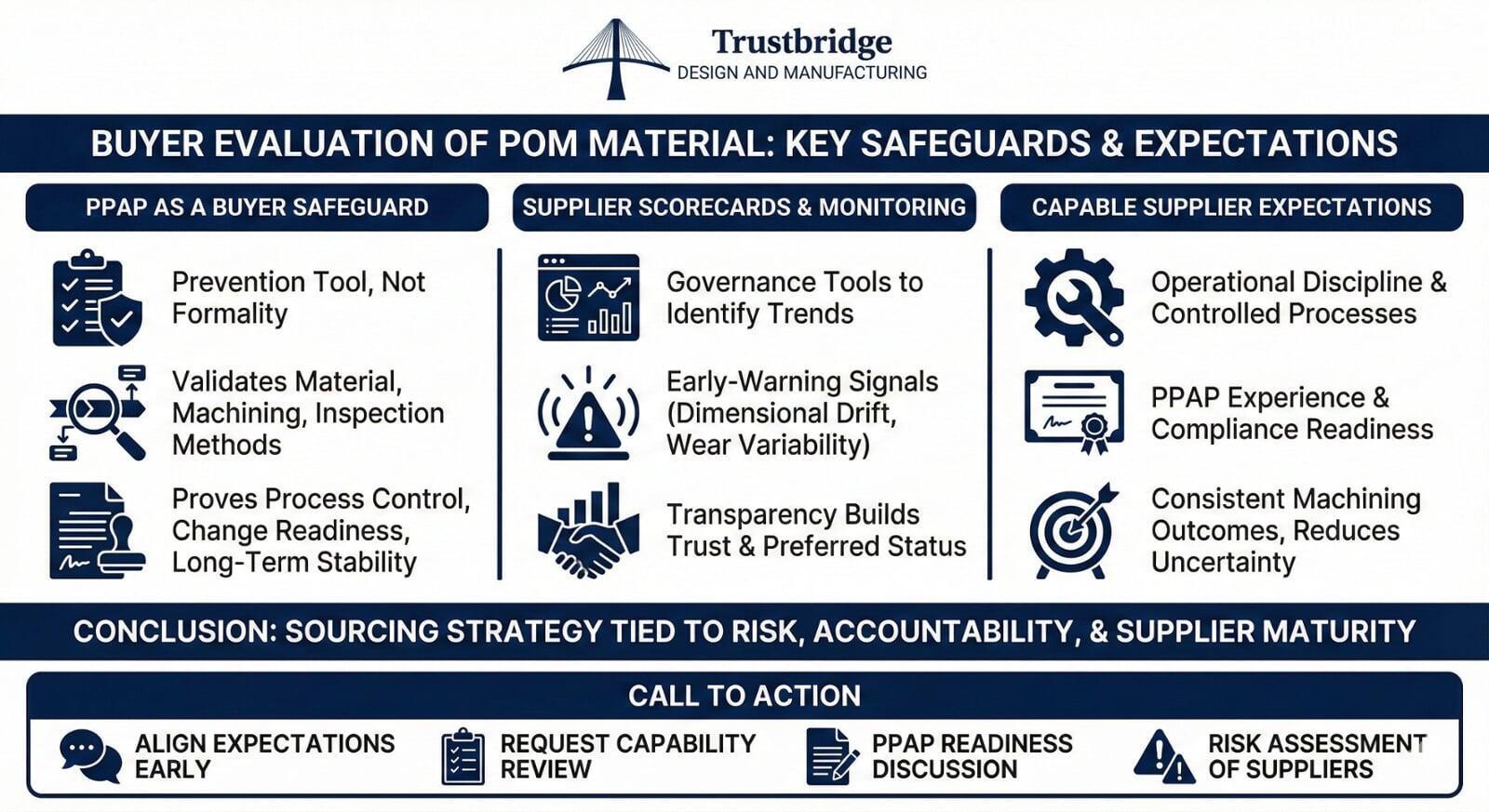

Production Part Approval Process (PPAP) as a Buyer Safeguard

PPAP is typically triggered when POM parts move from development into sustained production or when suppliers, materials, or processes change. For buyers, it serves as a prevention tool rather than a formality.

PPAP as Proof of Process Control

Through PPAP, buyers validate material selection, machining stability, inspection methods, and change control readiness. Depth matters here. Robust PPAP submissions build confidence that performance will remain stable beyond initial shipments.

Suppliers who support PPAP for acetal components demonstrate accountability through documentation, revision control, and disciplined process management, which reduces buyer intervention later.

Supplier Scorecards and Ongoing Performance Monitoring

Supplier scorecards typically track quality, delivery, responsiveness, and change management. Buyers use them as governance tools to identify trends, not just isolated issues.

How POM Performance Influences Supplier Ratings

Technical issues such as dimensional drift, wear variability, or late deliveries often share root causes tied to process control or communication gaps. Buyers treat these as early-warning signals with direct commercial impact.

Suppliers with transparent processes share data, flag risks early, and maintain stability. This transparency builds trust and directly supports preferred supplier status.

What Buyers Should Expect From a Capable POM Supplier

Buyers prioritize suppliers who demonstrate operational discipline through controlled processes, PPAP experience, compliance readiness, and consistent machining outcomes. These expectations align closely with procurement language around risk, continuity, and accountability.

Suppliers who actively reduce uncertainty help buyers meet internal objectives related to cost control, audit readiness, and long-term sourcing stability.

Conclusion

For buyers, evaluating POM material is no longer just a material decision. It is a sourcing strategy tied to risk exposure, performance accountability, and supplier maturity.

Strength, machinability, and durability deliver value only when backed by disciplined supplier processes. Buyers who apply mature evaluation frameworks reduce surprises, protect timelines, and strengthen long-term supplier relationships.

If you are sourcing or re-evaluating POM components, this is not about launching an audit. It is about aligning expectations early.

Procurement leaders, supplier quality teams, and engineering stakeholders can start by requesting a supplier capability review, a PPAP readiness discussion, or a risk assessment of current POM suppliers. These steps help surface issues early, reduce downstream disruption, and ensure long-term performance before problems reach the field.

Choosing the right POM supplier today safeguards product quality, production continuity, and your organization’s credibility tomorrow.

Frequently Asked Questions (FAQs)

1. Why do buyers evaluate POM material beyond basic strength specifications?

Strength alone does not guarantee long-term performance. Buyers evaluate POM material beyond datasheets because processing methods, machining practices, and supplier controls can significantly impact wear, dimensional stability, and field performance over time.

2. How does supplier capability influence the machinability of POM material?

Although POM is known for good machinability, results depend on how well the supplier controls tooling, cutting parameters, and inspection processes. Buyers assess machinability through tolerance consistency, surface finish quality, and repeatability across production batches.

3. Why is PPAP important when sourcing POM components for production?

The production part approval process (PPAP) helps buyers confirm that a supplier can consistently meet material, machining, and quality requirements before full-scale production. It reduces the risk of late-stage failures and production disruptions.

4. What signals indicate a reliable long-term POM material supplier?

Reliable suppliers demonstrate documented process controls, compliance readiness such as ISO 13485 or AS9100, transparent communication, and stable performance reflected in supplier scorecards over time.